draft kings 1099|Sports Betting Taxes: How to Handle DraftKings, FanDuel : Tagatay Winnings that meet certain state or federal thresholds must be reported by . Welcome! Grow business and revenues in an easy, efficient and profitable wayMisery Free Spins 3 . Misery Mining is a high volatility slot with a 96.09% theoretical return-to-player percentage (RTP), so be sure to keep an eye on your budget. The low house edge of 3.91% is great for those who want to take home the max payout possibility of 70,000x your bet.

PH0 · Where can I find my DraftKings tax forms / documents (1099/ W

PH1 · What are the W

PH2 · What are the 1099

PH3 · Understanding Your DraftKings Tax Withholding: Key

PH4 · Tax Considerations for Fantasy Sports Fans

PH5 · Statements, Taxes and Documents on DraftKings – Overview

PH6 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH7 · DraftKings Tax Form 1099

PH8 · DraftKings

Translate from English to Tagalog online - a free and easy-to-use translation tool. Simply enter your text, and Yandex Translate will provide you with a quick and accurate translation in seconds. Try Yandex Translate for your English to Tagalog translations today and experience seamless communication!

draft kings 1099*******If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you can access the information directly from the Financial Center. You can expect to receive your tax forms no .If you have greater than $600 of net earnings during a calendar year, you .Winnings that meet certain state or federal thresholds must be reported by .The best place to play daily fantasy sports for cash prizes. Make your first deposit!

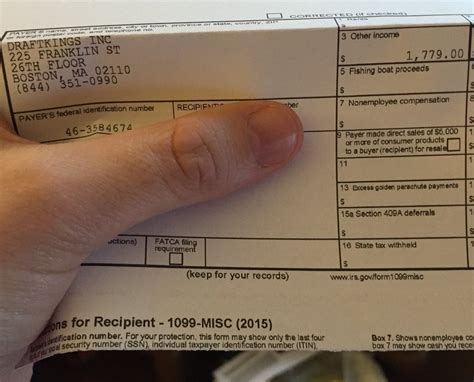

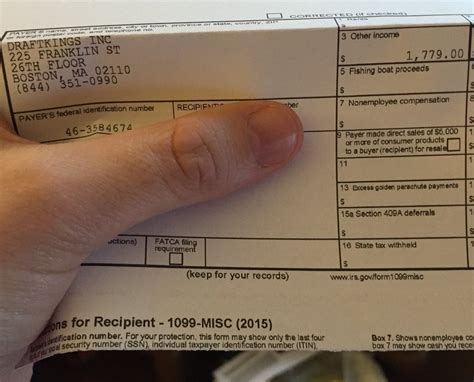

If you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings. This form will include all net earnings from the prior .Winnings that meet certain state or federal thresholds must be reported by DraftKings to the IRS for tax purposes. There may be tax withheld from your winnings, depending on how much . What kind of 1099 will you receive? You’ll likely get a 1099-MISC, which reports miscellaneous income. However, if you received your payouts from third-party payment .

If you need help locating your DraftKings Tax Form 1099, we have a handy guide to show you where it is and why and how to fill yours in.draft kings 1099 Sports Betting Taxes: How to Handle DraftKings, FanDuelThe best place to play daily fantasy sports for cash prizes. Make your first deposit!The best place to play daily fantasy sports for cash prizes. Make your first deposit!Fantasy sports organizers must send both you and the IRS a Form 1099-MISC or 1099-K if you take home a net profit of $600 or more for the year. Fantasy sports organizers use a formula to .

For winnings exceeding $600 in a year, DraftKings issues a 1099 form. This form reports total winnings for tax purposes. Locate these documents in the “Account” section of .

If in any calendar year your winnings total over $600, DraftKings will issue you a Form 1099-MISC. This form is essentially a record of your earnings from DraftKings that you .

Tax information, forms, and key dates. Our team is available 24 hours a day, 7 days a week.Navigate to the DraftKings Tax ID form. On the Confirm Your W-9 Filing page, below Name and mailing address tap/click the box next to Only issue me electronic tax forms . If all information on the screen is correct, eSign with your SSN or ITIN .

To ensure that DraftKings has the correct information for your tax forms, please visit the DraftKings Tax ID form to confirm or update your details.. Note: Fantasy app customers can update their IRS Form W-9 via desktop, laptop, or mobile web. For Draftkings Reignmakers "winnings" they send you a 1099 Misc. Entering that # in TurboTax in the "other" income section (where it belongs) doesn't give you an option to select gambling losses to offset the "winnings". There has to be a way to deduct the cost of the contests, otherwise I lost mo.draft kings 1099DraftKings Help Center (US) My Account; Tax Information; Tax Information Are my winnings on DraftKings subject to state interception? (US) Additional Ways to Contact Us. Mail: US Office. 222 Berkeley St. Boston, MA 02116. Support Hours. Our team is .

This form is similar to the 1099 form and serves as a record of your gambling winnings and as a heads-up to the IRS that you’ve hit the jackpot. You then must report all gambling winnings on your tax return. Even if you don’t receive the Form W2-G, you are still obligated to report all your gambling wins on your taxes. .

Sports Betting Taxes: How to Handle DraftKings, FanDuel Understanding Taxes on Winnings on DraftKings. All winnings from sports betting are subject to federal and state taxes. It’s crucial for players to report and pay any due taxes. For winnings exceeding $600 in a year, DraftKings issues a 1099 form. This form reports total winnings for tax purposes.THE CROWN IS YOURS Bet on all your favorite sports with DraftKings Sportsbook The only place I see where a 1099-MISC is applicable is Small Business/ Self employed which is not what my DRAFTKINGS form is from. Please advise as to where I input this other income that is not considered gambling however it was gambling winnings

DraftKings Tax Information | Paying Taxes On DraftKings Winnings | 1099 DraftKings | DraftKings Tax Rules | DraftKings 1099 . Language Translator} Appointment; Pay by Credit Card; Pay by ACH, E Check or Bank Draft; The Rescue Squad for Troubled and Overtaxed Taxpayers; Ph: 800 829 7483; A?We would like to show you a description here but the site won’t allow us.These are two different forms guys. The W9 is just information about you the player. Per the email you must fill it out to continue to play on draft kings. You should only get a 1099 if you profited over the normal $600 figure. Just fill out the W9 and worry about the 1099 if you won too much (good problem to have).DraftKings customers in the United States aren't taxed on their withdrawals. Learn more about what is reported to the IRS: Fantasy Sports; Sportsbook and Casino

The information provided by the player on the W-9 (name, social security number, and address) is used by DraftKings to populate IRS Forms W-2G and/or 1099-Misc. In the event your legal name, Social Security Number (SSN), or home address has changed, please fill out an updated W-9. Learn more about what is reportable to the IRS: Fantasy Sports

DraftKings Sportsbook is the best online platform for sports betting and more. You can sign up today and enjoy legal and secure betting on your favorite sports, teams, and events. Whether you use mobile or desktop, you will find the latest odds and offers from DraftKings Sportsbook.If you’re a US-based Sportsbook or Casino customer, you can also request a callback through the chatbot. If you’re a US-based Sportsbook or Casino customer, you can also request a callback from the DraftKings Customer Support Team by requesting a callback here.. Important Note: The option to request a callback is only available for logged in Sportsbook and Casino customers . View HTML: August 26, 2024: Filed by "insiders" prior intended sale of restricted stock. Non-EDGAR filing. 144Play blackjack, poker, roulette, slots and more all legally and securely, right from your phone!

How can Acrobat X change the page size? I have tried to “print” to PDF and changed the size to Arch E but still when I upload the new file to my measuring program, it is still 11x17. so when I zoom in the quality is horrible. . When I open a pdf file in Adobe Acrobat XI, the document always opens to a default size of 197%. I can change .

draft kings 1099|Sports Betting Taxes: How to Handle DraftKings, FanDuel